2018 Jeep Compass Low Oil Pressure Light

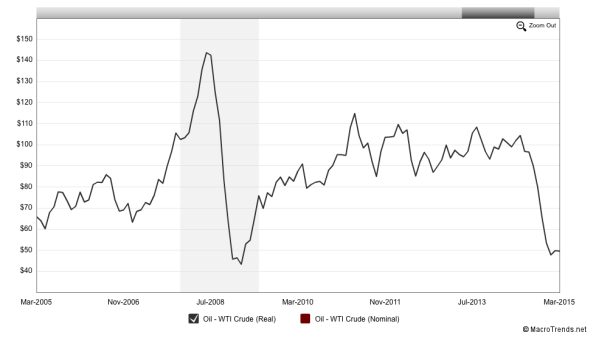

With oil prices falling 50% since last September, will 2015 be the year the clean-energy boom goes pop? Investments in solar, wind, biofuels, and other technologies surged to $310 billion last year. But, with the world soaking in cheap oil, there are people who think the boom cannot last.

On the face of it, there are reasons to believe the doomsayers might be right. For instance, if you bought a Nissan Leaf because gas prices were $3.50 a gallon, then $2-a-gallon prices make that decision seem like a less good one. You've paid a premium for an electric car and not seen the benefit from switching away from fossil fuels. Similarly, if your power plant runs on oil–as many do in the Caribbean and Middle East–then you're less likely to want to switch to a solar plant instead.

More to the point, there are historical reasons to fear for clean energy in the face of cheap oil. There was an American boomlet in ethanol, wind, and other renewables after the high oil prices of the 1970s, only for that bubble to burst with the oil glut of the 1980s. Some fear something similar could happen again.

On the other hand, there are good reasons to believe clean energy will be relatively unaffected, especially in the U.S., and especially for electricity. For one, we don't use oil to generate power; we use natural gas, coal, and nuclear. The most relevant competitor for solar and wind is natural gas, and the price for that has been low and holding for some time now, driven by the fracking boom. The renewables boom has continued apace.

"There's often a conflation that takes place in the media on what is power generation and what is transport," says Ethan Zindler, head of policy analysis at Bloomberg New Energy Finance. "Oil is used in limited situations in power generation, and so the price of crude oil in many power markets doesn't directly impact renewables."

Some solar-company stocks have been hit, but Zindler puts that down more to general volatility in those prices than anything fundamental. In fact, the outlook for solar is improving all the time because, unlike fossil fuels, solar is a technology, and technologies have a habit of getting cheaper and better as they mature. The price of a standard solar photovoltaic module has fallen 75% since the end of 2009, according to a recent report from the International Renewable Energy Agency.

Solar is likely to see a greater impact in developing countries that don't have good grid infrastructure. Communities that considered switching from diesel generators to solar panels may now think twice, though of course solar retains its intrinsic advantages, like the fact that you don't have to transport it to where it's needed. Investments in off-grid solar companies operating in the developing world reached $63.9 million in 2014.

Lower oil prices could also affect the political conversation around renewables–in a positive way. For example, it will be easier to make the case for a gasoline tax and for cutting fossil fuel subsidies if end prices are kinder to consumers. Similarly, it may make it easier for President Obama to reject the Keystone XL Pipeline project if we already have a lot of cheap oil, if that is what he decides to do.

As for electric cars, Zindler thinks lower-end models like the Chevy Volt will be more impacted than Teslas costing $60,000 and up. "There has been a lot of coverage of what this means for Tesla, which I find a little amusing. Most people buying Teslas today aren't terribly price-sensitive," he says.

2018 Jeep Compass Low Oil Pressure Light

Source: https://www.fastcompany.com/3040842/welcome-to-the-new-world-of-super-low-oil-prices